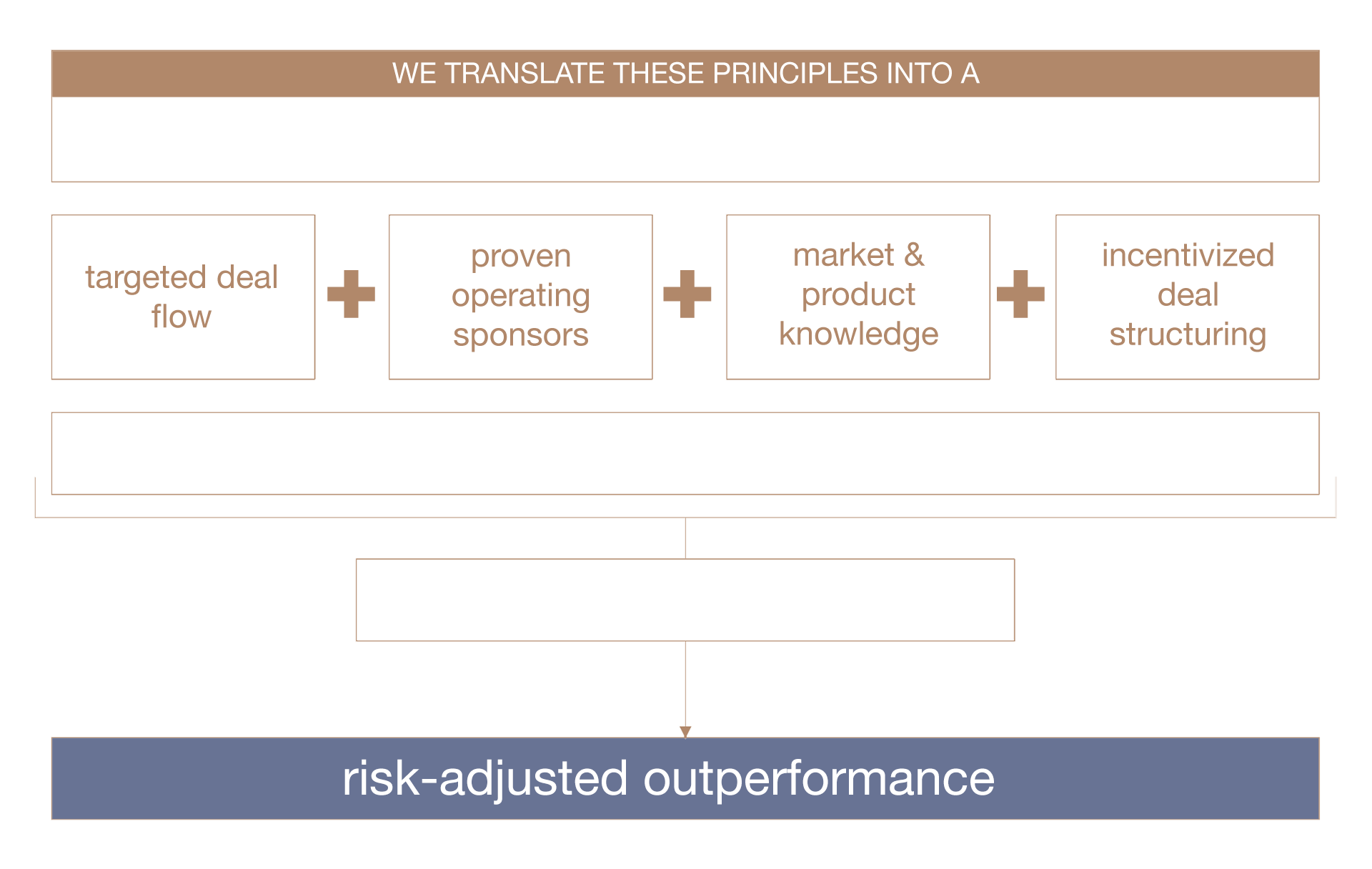

Most Rockstreet investments are made through joint ventures with highly skilled local operating teams that possess a distinguished track record in their respective product types and geographies. Known as our Resource Groups, they are drawn from the nation’s top real estate development, management and operating teams, specializing either in multifamily, retail, office, or industrial.